August 2025 RECAP

- The Chandan Economics Research Team

- Sep 2, 2025

- 3 min read

RECAP is a summary of last month's housing and commercial real estate research from Chandan Economics and our partners.

Published by Chandan Economics

August 2025 Rent Collections Report

By Chandan Economics Research

On-time rental payments in independently operated units improved in August 2025 — a positive development for a sector that has been dogged by declining performance for most of the year-to-date. According to this month’s first estimate, 83.2% of units paid their full rent on time — an increase of 34 basis points (bps) from July.

Despite August’s month-over-month improvement, on-time collections remain down substantially from a year earlier, underscoring that the financial health of renter households remains under stress. Compared to the same time last year, the rate is down a sizable 216 bps. While it currently stands as the third-largest annual decline in the post-pandemic era, it’s an improvement over the prior month’s movement (-279 bps). Nonetheless, August’s year-over-year decline marks 25 straight months of annual deterioration, with the on-time payment rate dropping by 502 bps in that time.

Late Payments Pile Up As Financial Strains Weigh on Renters

By Jason M. Davis

The three-month moving average of late payments in independently operated rentals has risen consistently since the middle of 2024, climbing from a low of 8.8% to a high of 11.7% in June 2025.

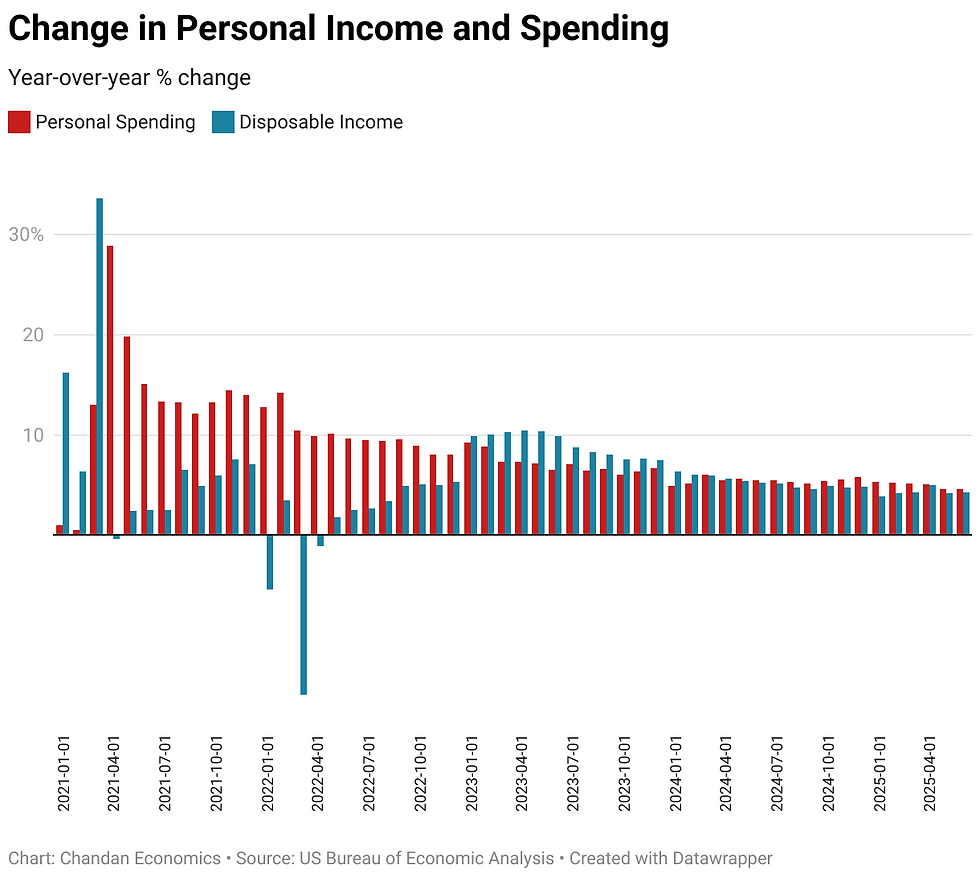

The growing share of apartment renters playing catch-up on their monthly bills may speak to broader distress in household finances. While late payments in apartment units operated by independent landlords tend to follow a seasonal pattern (falling in the spring before climbing in the late summer), the spring saw a sustained surge in late payments, possibly indicating a structural misalignment of renter cash flows.

We find that compared to the early pandemic years, the income constraints felt by renters today are not as acute. But as rising debt levels crowd out household spending on other items, renters are faced with a delicate balancing of financial priorities.

Published With Our Partners

Q3 2025 Small Multifamily Investment Trends Report

By Arbor Realty Trust, in partnership with Chandan Economics

Published with our partners at Arbor Realty Trust, the Q3 2025 Small Multifamily Investment Trends Report explores a wide range of topics within the small-asset subsector — including cap rates, asset pricing, refinancing activity, originations, and credit trends. Read the latest findings on Arbor's site by following the button below.

The Most Active Markets for New Multifamily Development in 2025

By Arbor Realty Trust, in partnership with Chandan Economics

After the volume of multifamily permits fell nationally in 2023 and 2024, this year is on pace to be a year of stabilization for multifamily development. According to the U.S. Census Bureau, out of the top 100 largest U.S. metros by population, 47 had more multifamily permits through the first six months of 2025 than they did over the same period last year.

Driven by strong underlying multifamily demand, attractive investment opportunities are leading to rebounding construction pipelines. As multifamily permitting rises, we explore the markets where new permits issued are most concentrated and where construction activity is gaining momentum.

Chandan in the News

Apartment Renters Feel Growing Financial Strain, and It Will Get Worse

Seen in Forbes

Forbes examines the results of the August National Rent Collections report by Chandan Economics/RentRedi. The article explores the latest data, the short-term outlook, and the potential implications that financial strains for US renters could have on the broader economy.

Small Multifamily Investment Trends Point to Market Rebound

Seen in CRE Daily

CRE Daily covers the results of the Q3 Small Multifamily Investment Trends report, developed by Arbor Realty Trust in partnership with Chandan Economics.

Late Rent Trends Show Financial Strain Among US Renters

Seen in CRE Daily

CRE Daily highlights recent Chandan Economics research showing the growing trend of US renters paying late and what it could signal about household finances and the state of the US economy.

Rent Collections Improve Slightly, but Late Payments Signal Strain

By Housing Wire

Housing Wire covers a recent Chandan Economics article discussing rising late payments by US renters and discusses why rising debt levels may threaten renters' financial stability.

CPI Report Boosts Fed Rate Cut Odds

By CRE Daily

CRE Daily highlights the results of Chandan Economics' Real Impact report, which showed that the July CPI report lifted the chances of a Fed rate cut in September as policymakers scrutinize the health of the US labor market.

Comments