The Greying of Gotham: The NYC Rental Market is Getting Older

- Jonathan O'Kane

- Jan 5

- 2 min read

A data-driven look at how an aging renter population is reshaping New York’s rental market and tightening housing access.

Over the past two decades, the NYC rental market hasn’t just grown — it has aged. Beneath the headline narratives about rent growth and post-pandemic volatility, a quieter structural shift has been unfolding: nearly all net growth in rental households has come from renters over the age of 35, while the number of under-35 renters has barely changed.

In 2005, renters under 35 made up just over 30% of all rental households in the NYC metro area. By 2024, that share had fallen to roughly 26.5%.

While the decline may appear modest, the underlying household counts tell a much sharper story. Over that period, the number of renters aged 35 and older increased by more than 540,000 households — a gain of roughly 24%. By contrast, the number of under-35 renters was essentially flat, rising by fewer than 10,000 households over nearly twenty years.

Younger renters exhibit far more volatility year to year, with sharp contractions during economic downturns and rebounds during recoveries. Older renters, by contrast, have shown steady, persistent growth through the Global Financial Crisis, the pandemic, and the post-pandemic period. Even the strong rebound among under-35 renters in 2022 merely returned that cohort to levels last seen more than a decade earlier, without restoring lost market share.

The implications are structural. As homeownership access has narrowed — particularly for younger households — renting has increasingly become a longer-term state rather than a transitional one. Older households are remaining renters for longer, whether by necessity, preference, or delayed mobility, while younger households face greater barriers to both renting independently and transitioning into ownership.

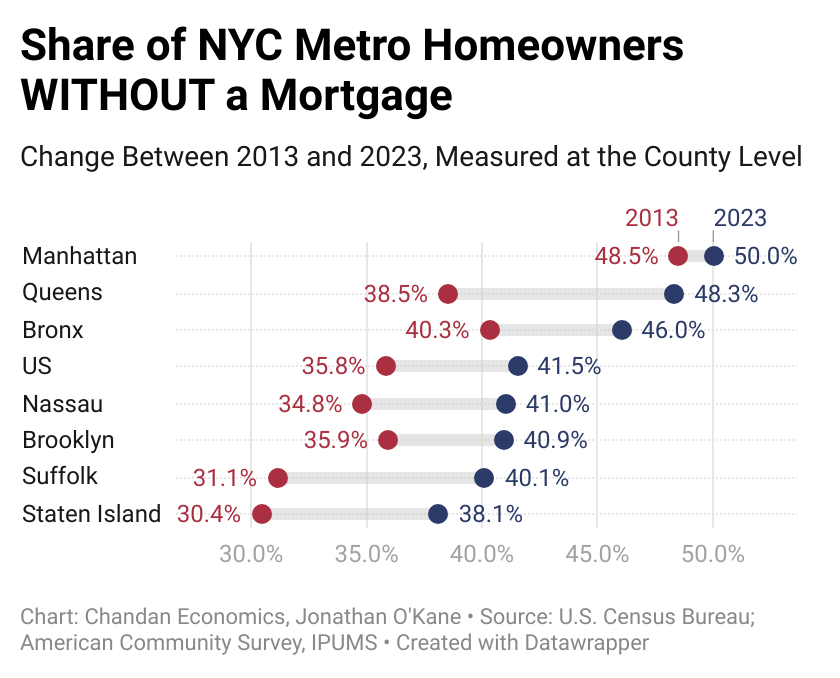

This shift also connects directly to broader supply dynamics. As older homeowners increasingly age in place — often owning their homes free and clear — fewer units circulate through the ownership market. Displaced demand flows into rental housing instead, where it increasingly competes for a stock that is being absorbed by older, more stable renter households.

The result is a rental market that feels persistently tight even in periods of slower population growth. The issue is no longer just how many renters there are, but who they are — and how long they stay. In the New York metro area, renting has become less of a stepping stone and more of a destination, reflecting a housing system where mobility is slowing and access is becoming harder at every stage.

Comments